- Stats: 3115 0

- Author: Linda

- Posted: February 28, 2019

- Category: Interac, Uncategorized

Interac by the numbers

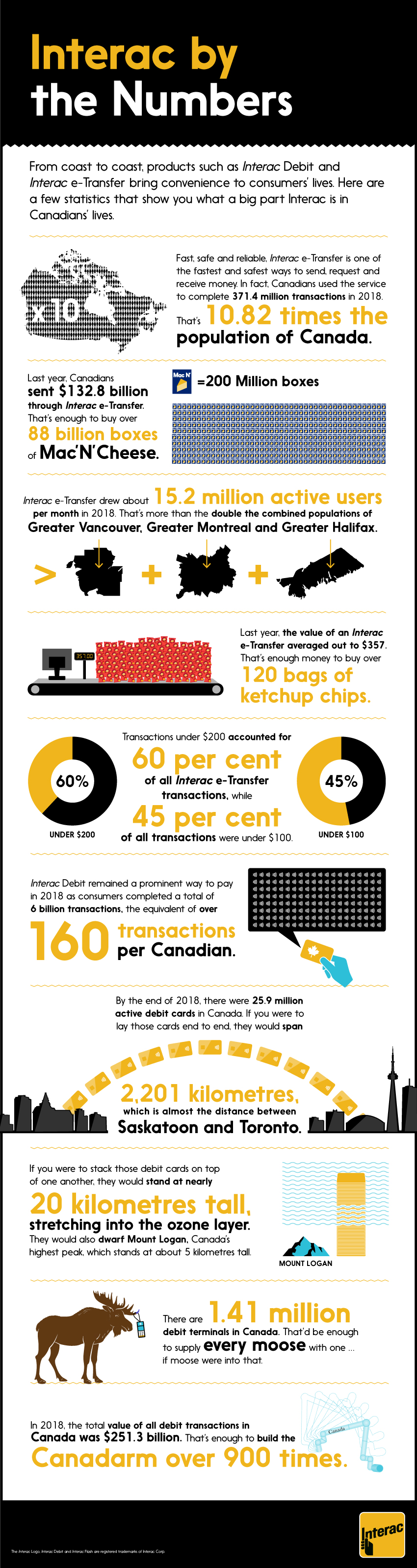

Throughout its history, Interac has helped Canadians access their funds their way. Products like Interac Debit and Interac e-Transfer have made money mobile, rescuing it from the confines of traditional banking and ushering it into the digital age. As consumers adapt to new technology, so does Interac. Online banking, mobile payments and other innovative offerings have helped redefine not only the ways Canadians do business, but also how they live their lives.

Results You Can Count On

The numbers bear out positive contributions Interac has on consumers’ lives, specifically when it comes to debit purchases. This year saw the total number of debit transactions increase by 216 million compared to 2017. A total of 498,248 merchants accepted debit in 2018, swelling by a total of 37,248 businesses. The sustained adoption and growth of debit suggests this payment platform continues to suit the changing needs of both consumers and businesses.

But Interac Debit wasn’t the only success story of 2018. The same year, the volume of Interac e-Transfer transactions rose 54 per cent from the previous year, up to 371.4 million transactions. The overall value of these transfers also increased by 45 per cent, while the service drew 15.2 million active users per month. The growth of Interac e-Transfer speaks to its convenience and security, as well as the desire among consumers and businesses for modern money movement.

With a variety of innovative products, Interac continues to facilitate everyday commerce for millions of Canadians. See how it’s using intuitive, adaptive technology to enable the future of business.