- Stats: 1346 0

- Author: Linda

- Posted: May 12, 2019

- Category: Retirement

Savings concerns drive Canadians to consider delaying retirement (but it doesn’t always work out that way)

Franklin Templeton’s 2019 Retirement Income Strategies and Expectations (RISE) survey found that over one-fifth (21 per cent) of Canadian young baby boomers (ages 55 to 64), in pre-retirement, have not saved anything for retirement. While in the United States, 17 per cent of young boomers are in a similar predicament.

This likely feeds into why nearly half of Canadian and American young boomers (46 per cent and 48 per cent, respectively) would consider postponing retirement, with approximately 15 per cent of Canadians and 13 per cent of Americans expecting to work until the end of their life. When looking specifically at self-employed Canadians, over one-fifth (22 per cent) don’t ever plan to retire.

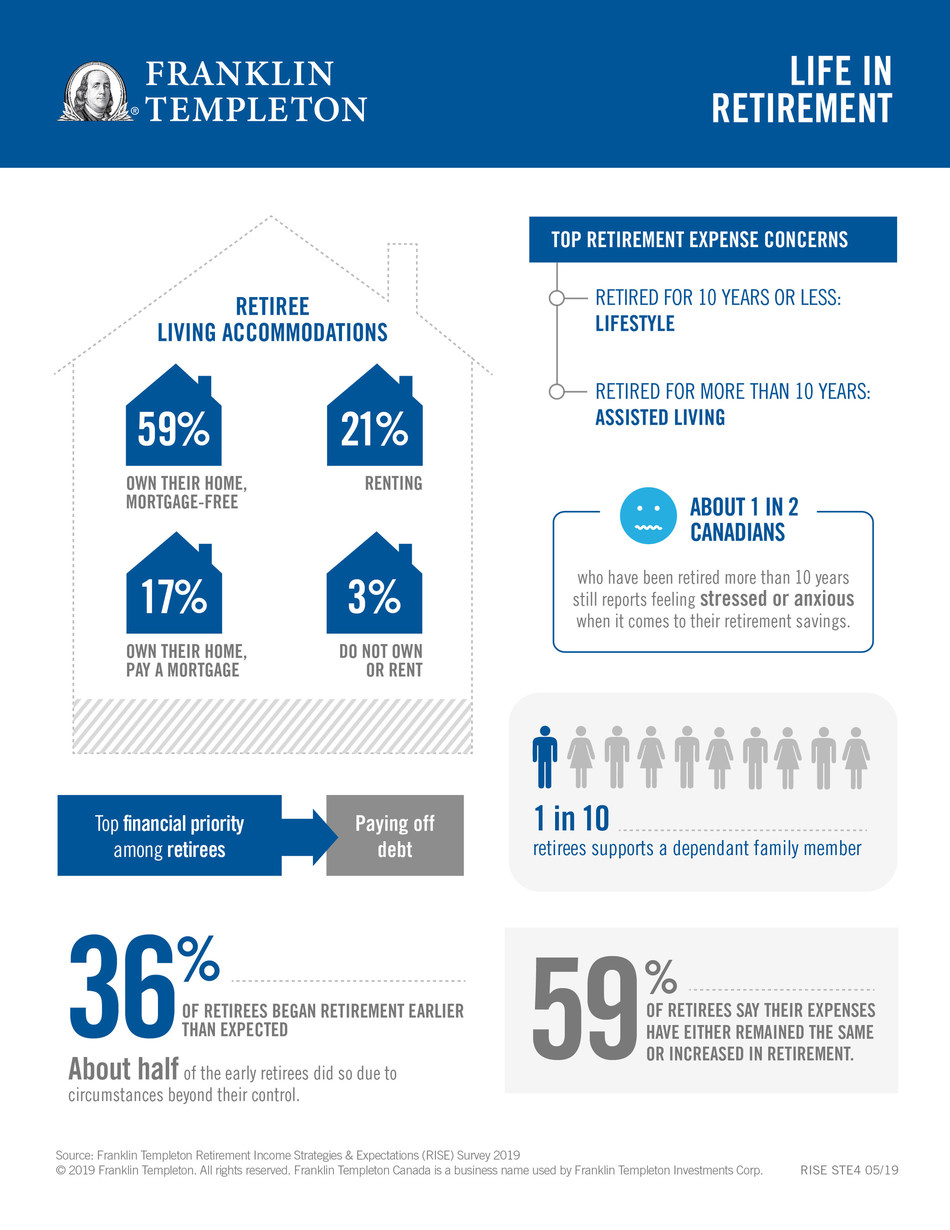

Yet it doesn’t always work out this way according to retired boomers, whether young or older. Over half of Canadian and American young boomers (54 per cent and 60 per cent, respectively) retired earlier than expected, compared to about one-third of Canadian and American older boomers (32 per cent and 37 per cent, respectively) ages 65 to 73.

There were also more Canadian young boomers who retired due to circumstances beyond their control than Canadian older boomers (34 per cent versus 20 per cent, respectively). There was a slightly wider gap amongst Americans, with more American young boomers who retired due to circumstances beyond their control than American older boomers (33 per cent versus 17 per cent, respectively).

“In 2009, when equity markets started to recover, many young boomers were moving up the career ladder; whereas older boomers were approaching retirement at the top of their earning years,” said Duane Green, president and CEO, Franklin Templeton Canada. “A decade later, after a long bull market run, young and older boomers are in different life situations once again. We see many older boomers benefitting from the transfer of wealth from their parents, yet the young boomers have had a challenging experience balancing more expensive lives – due to caring for elderly parents and still having financially dependent children – all while saving for that increasingly elusive retirement.”

Nearly a quarter (24 per cent) of Canadian young boomers, in pre-retirement, currently support a dependent family member, compared to nine per cent of retired older boomers. The top three sacrifices that young boomers had made for a dependent were: saving less money, cutting back personal spending and withdrawing from personal savings. They were least likely to use employer vacation time or take unpaid time off work for caregiving.

“With life expectancy increasing and retirement savings becoming ever more challenging, due to the high costs of living, we are seeing increased concern over having enough money for retirement across all generations,” said Matthew Williams, SVP, Franklin Templeton Canada. “Although it’s never too late to start saving, the best time to start contributing to retirement savings vehicles is when a person starts out in their career and may not have big financial commitments like a mortgage or childcare costs—and to find a way to maintain healthy savings habits as they age.”

He added, “Those who are employed by a company that offers a group RSP or pension that allows employees to make contributions directly from their paycheque—and potentially even receive a company match to their contributions—should fully take advantage of this benefit and potential ‘free’ money, as it will assist their retirement nest egg in compounding over time.”

Surprising concerns about retirement expenses

Of those Canadians who plan to retire within five years, 86 per cent expressed concerns about paying expenses in retirement. Looking across specific expense categories, over a quarter (27 per cent) of these Canadians nearing retirement ranked lifestyle as their top concern, compared to 17 per cent of Americans. Instead, Americans who plan to retire within five years are most concerned about medical and pharmaceutical expenses (23 per cent), while 18 per cent of Canadians express the same concern. This is likely because over one-third (34 per cent) of Canadians nearing retirement, and over one-quarter (27 per cent) of Americans, do not know how they will pay for their medical expenses in retirement.

Surprisingly, Canadian millennials are more worried about medical and pharmaceutical expenses in retirement with 22 per cent expressing concern, likely because three in five (61 per cent) do not know how they will pay for these expenses.

This concern about retirement expenses appears to be well founded, as over one-third of Canadians and Americans who are 11 or more years into retirement (34 per cent and 35 per cent, respectively) said their overall expenses have increased since they initially retired. Yet when Canadians 11 or more years into retirement were asked about what expenses they are concerned about, over a quarter (27 per cent) ranked assisted living care expenses as their top concern.

These expenses are weighing on those Canadians nearing retirement in the next five years as over half (52 per cent) are concerned about outliving their retirement assets or having to make major sacrifices in their retirement. Yet Canadians who are 11 or more years into retirement are 21 percentage points less likely to be concerned about this (52 per cent versus 31 per cent).

Canadians stressed and anxious about having enough for retirement

Nearly three-quarters (73 per cent) of young boomers, in pre-retirement, and millennials experience stress and anxiety when thinking about their retirement savings and investments. This is likely because one-fifth (21 per cent) of young boomers and a quarter (24 per cent) of millennials haven’t saved anything for retirement.

Over half (58 per cent) of those who are self-employed feel they are behind on their retirement savings, which might be causing almost three-quarters (74 per cent) of business owners stress and anxiety when thinking about their retirement savings.

Savings and the advice factor

The survey found that nearly half (47 per cent) of young boomers currently work with a financial advisor. Those who do are 37 percentage points more likely to be saving for retirement compared to those who have never worked with an advisor (96 per cent versus 59 per cent).

“Regardless of what generation someone is in, getting advice and creating a savings and retirement strategy is an important step towards ensuring they meet their future goals,” said Liz Bouthillier, SVP, Sales, Franklin Templeton Canada. “As many people continue to live longer due to advancements in health care, the chances of outliving their retirement savings increases. In addition to helping people save for retirement, financial advisors are a vital resource in assisting retirees with generating and understanding the various sources of retirement income.”

When asked if their retirement strategy will generate enough income to last 30 years or more, more than three-quarters of retired young boomers (77 per cent), who work with a financial advisor, said it will—compared to 45 per cent of those who have never worked with an advisor. Of those retired young boomers who have never worked with an advisor, 37 per cent stated that they don’t have a retirement strategy whatsoever.

Additional key findings

- Over one-fifth (21 per cent) of Canadians planning to retire in the next five years still have children living at home and almost one-third (31 per cent) are still paying a mortgage.

- Over one-third of millennials, who rent their home, have nothing saved for retirement but half (50 per cent) of millennials who rent have up to $50,000 saved for retirement.

- One-third (33 per cent) of millennials are most concerned about running out of money in retirement.