76% of Pay Cheque To Pay Cheque Canadians Lack Confidence In Their Banks Supporting Them During Financial Difficulty

Progessa, released findings from its non-prime consumer survey revealing that 76% of respondents thought their banks would not help out in a difficult financial situation.

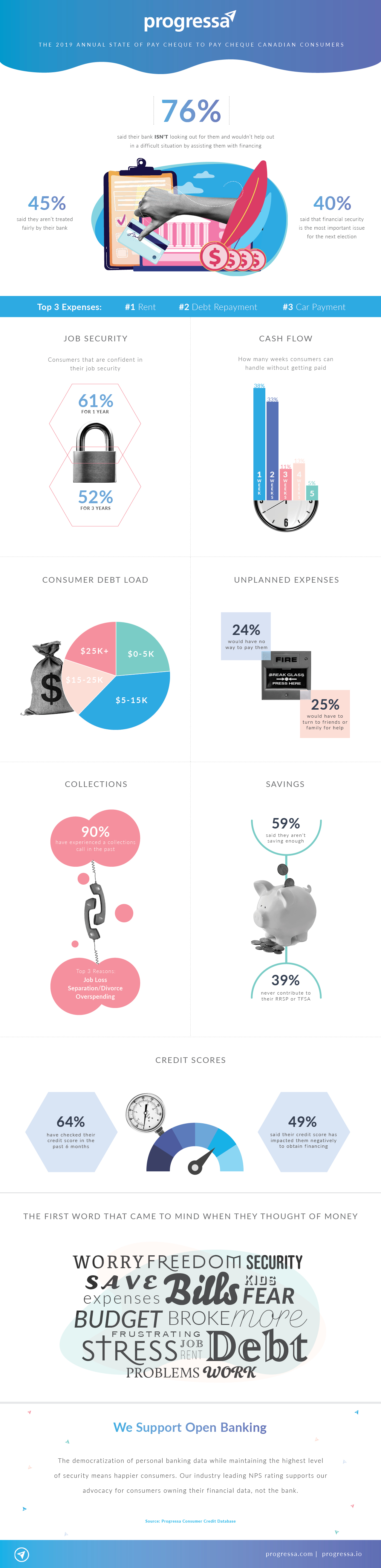

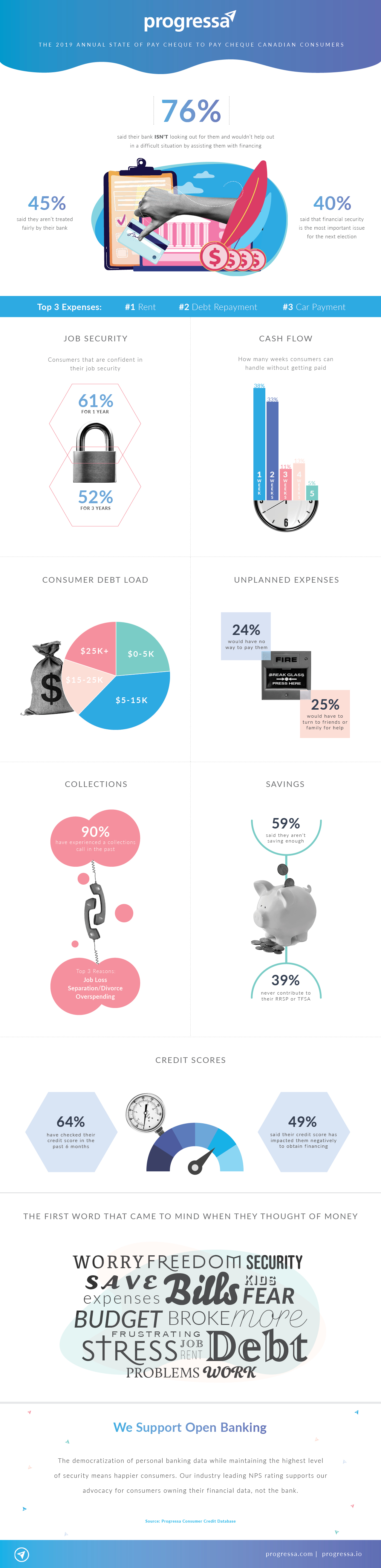

Respondents were asked questions related to their income, expenses, debt load, budget management, and credit monitoring. The results raised some concerns over how much financial literacy education Canadians require, but more importantly, this survey showed some clear signs that Canadians are stressed over not being prepared for difficult financial situations and not having available options to help if they were to fall on hard times.

When asked “what is the first word that comes to mind when you think of money”, the most frequently written responses included “bills”, “stress”, “struggle”, and “anxiety.”

Other key findings included:

- 52% are very confident about their job security over the next 3 years, but only 29% could handle not getting paid for 3 weeks or more. 38% of respondents said they could only go one week without getting paid, while another 33% could handle two weeks without getting paid

- Only 36% have contributed to their RRSP or TFSA over the past year, while 39% said they have “never” contributed

- 24% would have no way to pay for an unplanned emergency expense, and another 25% would have to turn to friends and family for help. In other words, nearly half of respondents are not financially prepared for difficult financial situations

- 61% have up to $15,000 in debt (not including mortgages)

The economy and job security are the most important election issues this fall, indicated by 40% of respondents. This significantly trumps health care (29% of respondents) and the environment (8% of respondents)

34% have not checked their credit scores in the last 6 months

“This survey indicates pay cheque to pay cheque Canadians are not getting the support they need from their primary financial institutions when they need it the most,” said Jason Wang, Progressa’s Vice President of Risk Analytics. “Most banks use a traditional credit model that is not as effective in scoring credit-impaired consumers.”

In addition, with both Canadian credit bureaus, TransUnion and Equifax continuing to sound alarms that Canadians are taking on record amounts of debt relative to income and most of Canada’s big 5 banks reporting higher than expected loan losses in Q1 of 2019, Progressa is seeing record demand for its products and services, all purpose built to tackle the issue of debt and help Canadians avoid insolvency.

Progressa CEO Ali Pourdad cautions “All Canadian consumers, but especially those living pay cheque to pay cheque, need to take a hard look at their spending and savings patterns and begin planning better for a rainy day. Most, if not all of our customers have been at some point in their recent lives caught in a difficult financial situation, although often unavoidable, could have made things significantly less stressful for themselves with better financial habits and planning.”