- Stats: 1212 0

- Author: Linda

- Posted: October 1, 2019

- Category: Financial Literacy

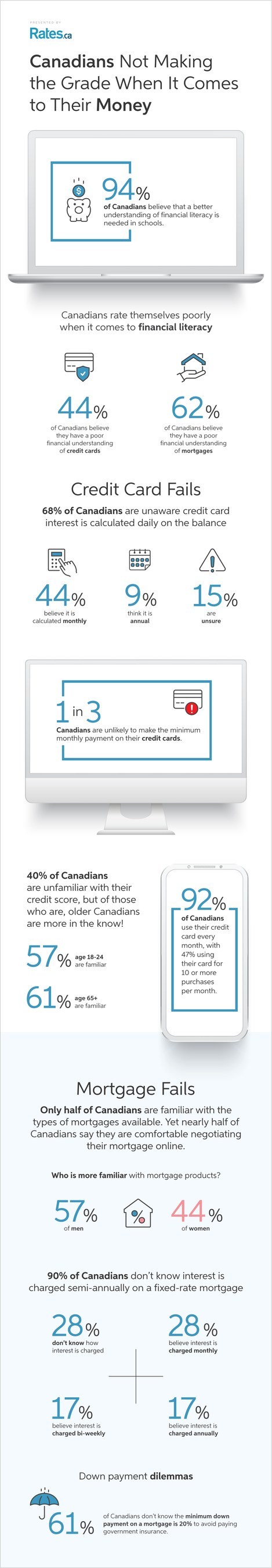

Many Canadians grade themselves “C” or worse when it comes to money matters

Canadians give themselves dismal grades when it comes to their understanding of common financial products, according to a national survey released today by insurance and money product comparison site Rates.ca. Specifically, when considering financial literacy about credit cards and mortgages, 44 per cent and 62 per cent of Canadians respectively assessed their skills at six or below out of 10.

Financial literacy as it relates to credit cards is more evenly split down gender lines (48 per cent for women vs. 41 per cent for men), while more women than men rank themselves at six or below when considering their knowledge of mortgages (67 per cent vs. 55 per cent).

An overwhelming majority of Canadians surveyed (94 per cent) believe that schools should place a greater emphasis on teaching financial literacy. Close to half (46 per cent) of respondents said that children should be independent and in charge of their own credit cards by age 18, while over one third of Canadians feel that 21 is the appropriate age for this responsibility. Moreover, 15 per cent of respondents feel young adults are not ready for their own credit card until age of 25.

Other Rates.ca survey findings:

- Forty per cent of Canadians surveyed don’t know their credit score.

- More than a third of respondents (36 per cent) of respondents share a joint credit card with either a partner, parent or children.

- When it comes to negotiating a mortgage, 43 per cent of respondents were comfortable accomplishing this task online, compared to 57 per cent who preferred to work out a deal in person.

To review full survey, visit Rates.ca.