- Stats: 1258 2

- Author: Linda

- Posted: November 4, 2019

- Category: Equifax, Holiday Shopping

More Canadians Planning to Spend Less this Holiday Season

In advance of Black Friday more than half of Canadians (55 per cent) say they will be spending less on holiday gifts this year, according to a recent survey* by Equifax Canada. This comes following Equifax Canada’s Q2 Consumer Credit Trends Report, which showed total debt per consumer rose by +1.9 per cent at the end of the second quarter in 2019.

According to the survey, women were more likely to say they would be spending significantly less at 61 per cent versus 48 per cent of men. Canadians under the age of 55 were significantly more likely to agree they will limit their spending because they are already carrying too much debt, and they have a lot of anxiety about their current level of debt. Survey respondents between 35-44 had the most concern about current debt levels (58 per cent compared to 46 per cent for the general population) and the most anxiety (49 per cent compared to 39 per cent for the general population). The majority of people surveyed, however, are working towards being financially fit for the holidays with 58 per cent of them planning to prepare a holiday budget.

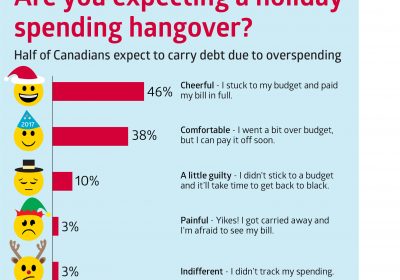

When asked how long it would take to catch-up on their holiday spending, one-in-three (36 per cent) of survey respondents said it takes them a month or more. As a further indication of where Canadians stand with their debt obligations, Equifax Canada’s Q2 Consumer Credit Trends Report found the rate at which consumers were missing monthly payments was higher and bankruptcies also continued to rise as compared to last year. Newfoundland (+11%), Alberta (+7.9%) and Ontario (+7.8%) led the way higher in 90+ day delinquency rates in a year-over-year comparison.