- Stats: 1506 0

- Author: Linda

- Posted: November 22, 2019

- Category: Manulife Bank

Is household debt cracking Canada’s financial foundation?

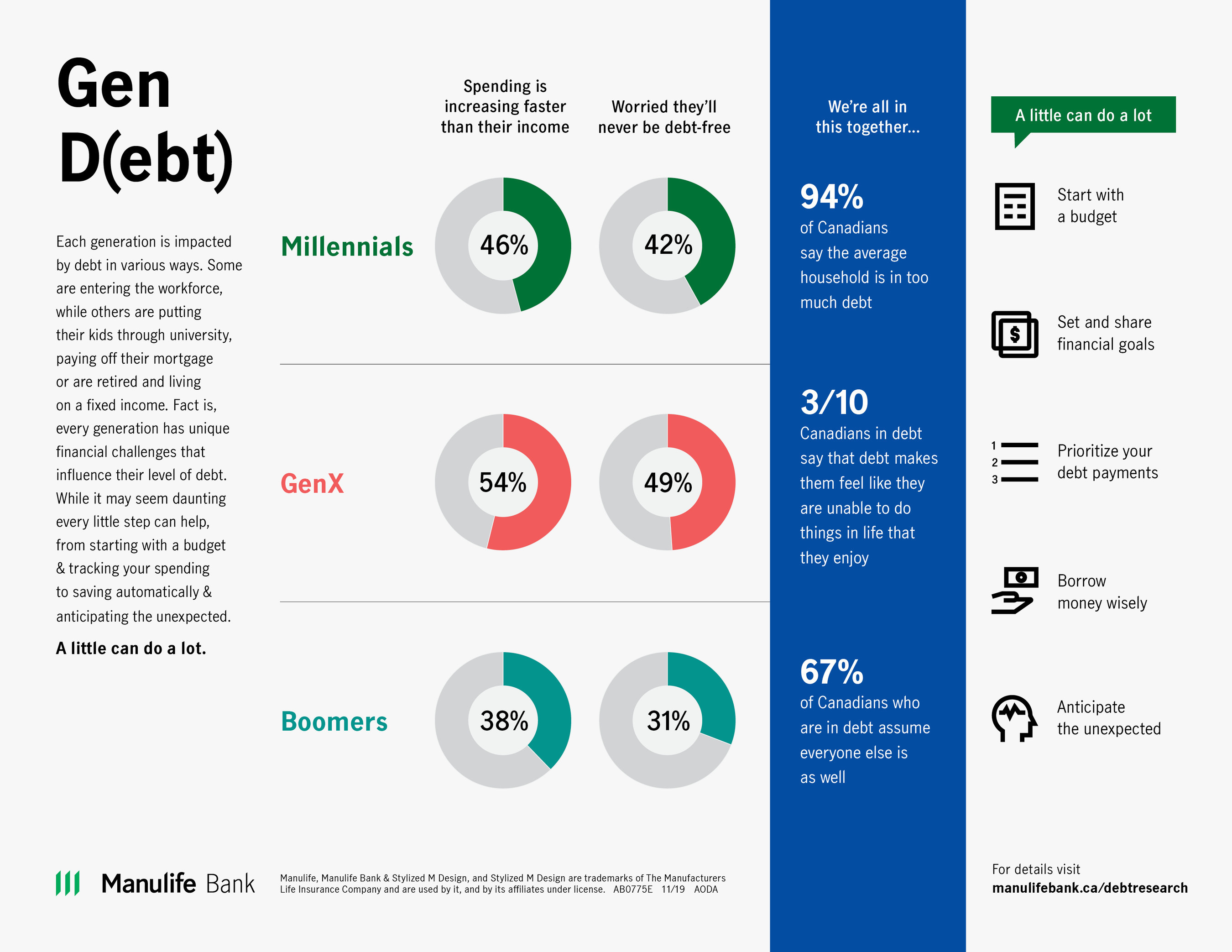

An overwhelming majority of Canadians agree the average household is in too much debt according to the latest findings from Manulife Bank Debt Survey. Likewise, two-in-five indebted Canadians do not expect to escape it in their lifetime and the incidence of Canadians with considerable non-mortgage related debt is climbing.

Virtually all Canadians (94 per cent) surveyed agree the average household is in too much debt. Since Spring 2019, there has been a nine-point increase (55 per cent vs. Spring 2019 at 46 per cent) in the incidence of Canadians who report having considerable non-mortgage related debts. Sixty per cent of them report that they have non-mortgage related debt on credit card(s) that carry a balance, a twelve per cent increase over what was observed in Spring 2019 (48 per cent).

Financial outlook by generation

Are Canadians living in Generation Debt? Baby Boomers are in much better financial shape than their Generation X and Millennial counterparts, both of which are struggling. Three-in-five Baby Boomers surveyed noted they are better off financially than their parents were at the same age, compared to just under half (49 per cent) for Generation X and Millennials.

Generation X, which perceives itself as being in the most debt, saves the least of its after-tax income and is most likely to report that spending is outpacing income, and is the most skeptical about ever being debt-free in its lifetime according to the survey.

Millennials are struggling too, as they have experienced the most difficulty when trying to enter the workforce (14 per cent stated they struggle a lot versus nine per cent for those aged 41-69 years old). However, things are not entirely bleak for this group as they are among the most likely to indicate that their income is increasing faster than their spending (14 per cent versus 10 per cent for those 41-69 years old). Technology may also help them get into better shape financially than their predecessors. Three in four millennials feel it is important to have access to financial plans online, preferably through an app.

Over half of indebted Millennials who feel in control of the situation indicate that technology has helped them manage their debts compared to just one in three Generation X & Baby Boomer Canadians.

Relationships and finance

Approximately nine-in-ten Canadians feel comfortable sharing their complete financial picture with their spouse.

While many share financial responsibilities with their partner, of the 21 per cent of people who do not combine finances and are not considering it, 41 per cent cite ideology and more specifically a mutual belief that financial autonomy is important (23 per cent). In addition, nine per cent cited their partner’s shopping addiction and another three per cent noted their partner’s addiction to drugs and/or alcohol as reason to keep finances separate.

Competing financial priorities can make it hard to manage finances while in a relationship. Should you focus on paying off debt, maxing out your retirement contributions, budgeting for a down payment on a house, or saving up for that big trip abroad? Sorting out financial goals and identifying what matters most is a smart way to create an actionable financial plan.

Learn more about the Manulife Bank of Canada Debt Survey and ways to manage finances by visiting: www.manulifebank.ca/debtresearch