Greedyrates, a leading personal finance site, has released a report examining the past decade of Canadian spending habits. The report found that Canadians are feeling…

Greedyrates, a leading personal finance site, has released a report examining the past decade of Canadian spending habits. The report found that Canadians are feeling…

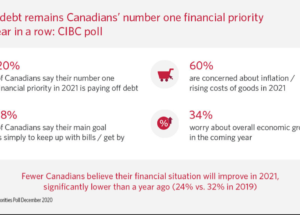

Despite a global pandemic and financial uncertainties, a new CIBC study finds that for the 11th straight year, paying down debt remains the number one financial…

The annual BDO Canada Affordability Index, which examines how affordable life is in Canada, reveals that as Canadians struggle to make ends meet and manage growing debt,…

Progressa is Canada’s fastest growing financial technology lender focused on changing the way pay cheque to pay cheque Canadians access and build credit. Since 2013,…

Progressa, has surpassed the $100 million milestone in funded loans for underserved Canadian consumers. Since 2013, Progressa has helped tens of thousands of Canadians improve…

One-in-five Canadians with debt say they will need to liquidate assets (e.g. cash in their RRSPs, get a second mortgage, sell a vehicle, etc.) to…

The proportion of Canadians who are $200 or less away from financial insolvency at month-end has jumped a significant six points since September, from 40…

A national survey, commissioned by Financial Planning Standards Council (FPSC) and Credit Canada in time for Blue Monday (January 15), reveals that more than half…

With interest rates expected to rise in the coming year and household debt in Canada still climbing, a new CIBC (CM:TSX) (CM:NYSE) poll finds paying…