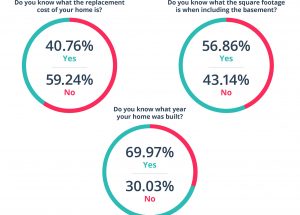

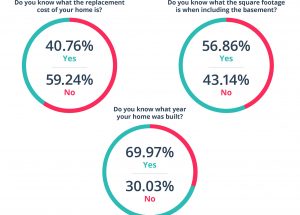

A recent home insurance survey conducted by LowestRates.ca found that the majority of Canadians don’t know key details about their homes, meaning when it comes…

A recent home insurance survey conducted by LowestRates.ca found that the majority of Canadians don’t know key details about their homes, meaning when it comes…

Sonnet Insurance wants to empower Canadians to recognize and prevent potentially harmful scams. Home and auto insurance seller fraud is common in all regions of Canada,…

Nearly a quarter of Canadians have not read their home (23%) or car (25%) insurance policies, yet the main worries that keep us up at…

While 72 per cent of Canadians had some form of travel or medical insurance for recent travels, most leave their family under-insured, according to a survey…

Tight airport security and flight delays can definitely be a downside to air travel, but the biggest pet peeve for over a quarter (27 per…

Across Canada, severe weather is on the rise. Currently in Eastern Canada, many are suffering the devastating effects of spring flooding. As the incidents of…

Sonnet Insurance has launched Sonnet Connect, a new way to protect, improve, and simplify life for Canadians. Known for simplifying the insurance experience, Sonnet has partnered…

InsuranceHotline.com believes Ontario drivers should have barrier-free access to their driver’s record and insurance history, especially in today’s digital world. Drivers in Ontario currently do not…

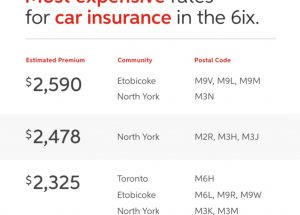

From Hamilton to Brampton, Vaughan to Whitby, drivers in the Greater Toronto Area(GTA) pay more for auto insurance than drivers elsewhere in the province. According to Kanetix.ca’s InsuraMap, the average Ontario auto insurance…