Fidelity Investments Canada ULC, released the 2021 Fidelity Retirement Report. In its 16th year, this report focuses on both longstanding and emerging factors affecting Canadians’ retirement planning.…

Category:Retirement

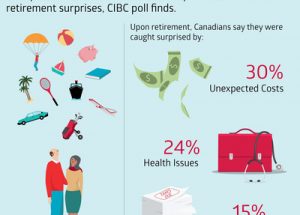

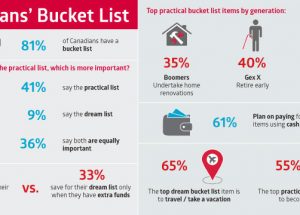

A new CIBC poll finds that 81 per cent of Canadians have a bucket list of things they hope to accomplish one day — but…

it’s been 10 years since TFSAs (Tax-Free Savings Accounts) first appeared and while they’re proving to be Canada’s savings superhero, their true super power remains dormant. Canadians…

Fidelity Investments Canada ULC, one of Canada’s top investment management firms, today released Retirement 20/20, an annual survey that examines opportunities and challenges facing Canadians…

Franklin Templeton’s 2019 Retirement Income Strategies and Expectations (RISE) survey found that over one-fifth (21 per cent) of Canadian young baby boomers (ages 55 to 64),…

The National Retirement Planning Coalition, comprised of prominent education, consumer advocacy, and financial services organizations, recognizes the need to educate Americans on retirement planning and…

Non-retired Canadians have big numbers in mind for the money they’ll need to save to ensure a comfortable financial future – averaging as high as $1.07…

A worry-free retirement may be a thing of the past as Canadians struggle to manage debt. From living with a mortgage to unpaid credit cards,…

Life expectancy in Canada has greatly increased, leaving many Canadians at-risk of outliving their retirement savings. According to TD’s Retiring Solo survey, nearly half (47 per cent) of Canadians…