- Stats: 2807 0

- Author: Linda

- Posted: September 26, 2019

- Category: CIBC, Small Business

Business owners report long hours, little or no vacation and giving up hobbies: CIBC poll

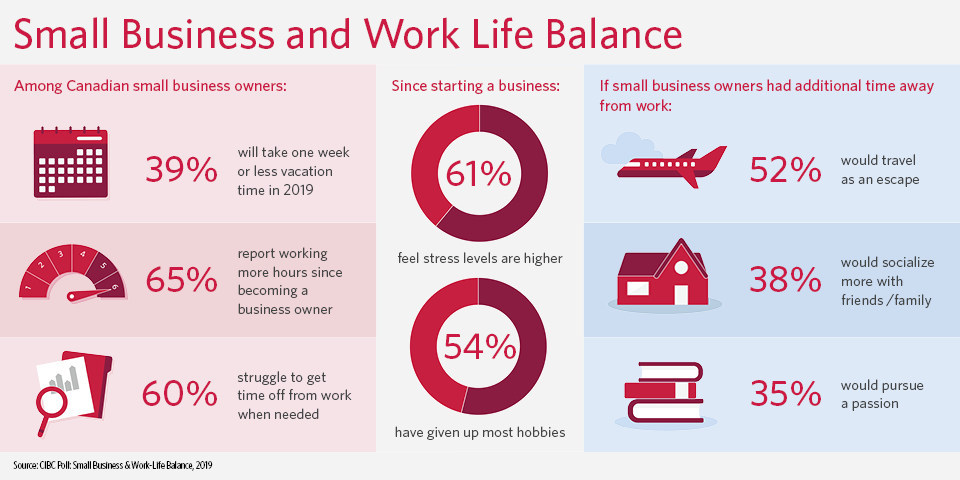

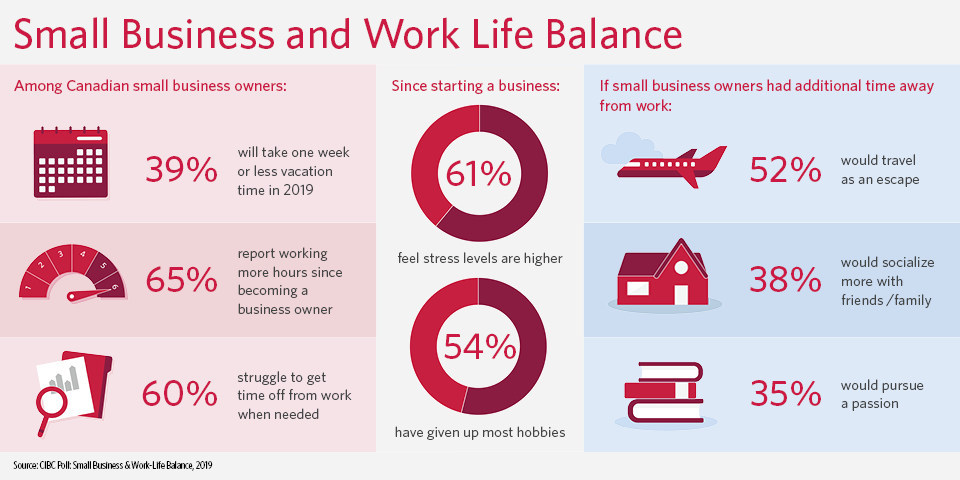

With summer vacation in the rearview mirror, many Canadian entrepreneurs may be asking: “what vacation?” The new CIBC SmartBanking™ for Business Survey of 1,005 business owners across the country reveals that four-in-10 (39 per cent) have taken little or no vacation time in 2019 and life for many has become more stressful with less leisure time since starting a business.

According to the poll:

- Two-thirds (65 per cent) report working more hours

- 61 per cent feel their present stress levels are much higher

- More than half (54 per cent) have given up most hobbies and extra-curricular activities

- 60 per cent struggle to get time off from work when needed

“Entrepreneurs wear many hats to ensure their enterprise runs smoothly and profitably. But this often creates real obstacles in achieving work-life balance,” said Andrew Turnbull, Senior Vice-President, Business Banking, CIBC. “Time spent on bookkeeping, accounting and payroll is contributing to the problem and business owners have been telling us they spend too much time on these activities.”

Integrated banking, accounting and payroll solutions is the future

In May, CIBC introduced SmartBanking™ for Business, a first-of-its-kind banking platform designed to help small and medium-sized businesses run and grow their companies and manage their banking, accounting and payroll in one place. To accomplish this, CIBC integrates information with leading cloud accounting packages, QuickBooks Online and Xero, and payroll software, Ceridian Powerpay Plus. It is available online and for iPad to download free on the App Store, with no monthly access fee.

CIBC embarked on the SmartBanking for Business journey as it became clear that entrepreneurs are always looking for ways to drive efficiencies within their business. Administrative processes such as month-end closing can take time for both business owners and their accountants, with reconciliation activities and follow up taking anywhere from 8 to 10 hours per week or 30 per cent of an accountant’s time each year*.

“CIBC SmartBanking for Business is one of the ways we are helping business owners save time so that they can focus on higher value aspects of their business and find more time for leisure and balance in their lives,” Mr. Turnbull said.

How would small business owners spend their extra time?

If they had additional time away from work, Canadian business owners said they would consider:

- Travelling, with more than half of respondents (52 per cent) choosing to escape;

- Socializing with friends/family, a favourite with four-in-10 business owners (38 per cent);

- Pursuing a passion, hobby or activity (35 per cent) and exercising/playing sports (34 per cent);

- Getting more rest (28 per cent) and relaxing or meditating (26 per cent).

“Passion and dedication are two of the hallmarks of a successful entrepreneur,” said Mr. Turnbull. “Business owners make huge contributions to the Canadian economy and to our communities. Our aim is to support Canadian entrepreneurs with innovative solutions that give them more time to focus on what matters most – from growing their business to enjoying hobbies and family.

About the CIBC SmartBanking™ for Business Survey

From August 8th to August 18th 2019 an online survey of 1,005 Canadian Small Business Owners who are Maru Voice Business Canada panelists was executed by Maru/Blue. For comparison purposes, a probability sample of this size has an estimated margin of error (which measures sampling variability) of +/- 3.1%, 19 times out of 20. Discrepancies in or between totals are due to rounding.