- Stats: 853 0

- Author: Linda

- Posted: February 3, 2021

- Category: Holiday Shopping, Holidays, TD Bank

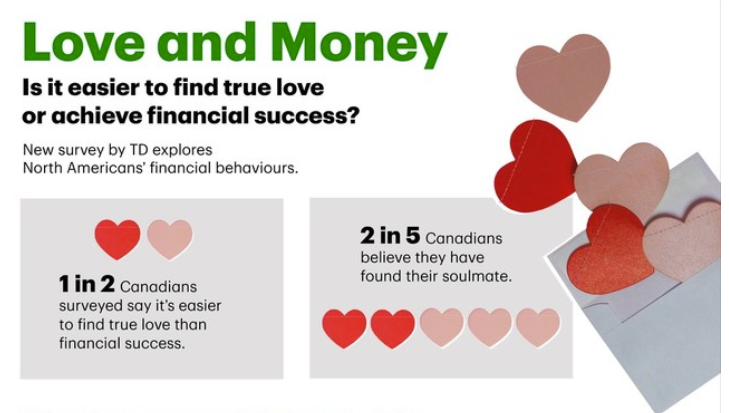

1 in 2 Canadians surveyed say it’s easier to find true love than financial success

According to Love and Money – a survey from TD exploring the financial behaviours of more than 3,000 married, in a relationship or divorced North Americans – half of Canadians surveyed (49%) believe it’s easier to find true love than financial success. However, that’s not to say those Canadian couples surveyed aren’t feeling cautiously optimistic about their future financial goals.

Despite challenges from the pandemic, nearly nine-in-ten (88%) Canadian survey respondents are currently saving for something. For those already in a committed relationship, the survey also reveals that for most couples (45%) it has been easy to talk about money during COVID-19. Nearly half (49%) of Canadians surveyed say the pandemic has led to more open and constructive conversations about their finances, including the need to adjust spending habits by reducing spending on non-essential items (62%) and delaying larger purchases (36%).

The “talk” – when and how often?

With Love and Money revealing that six out of ten (60%) Canadian couples surveyed are having trouble meeting their financial goals during the COVID pandemic, it’s clear that having conversations about money are critical. In fact, “not talking about money with my partner on a regular basis” is the top financial mistake noted amongst Canadian respondents. Fortunately,

- 77% of Canadian couples surveyed say they typically open up about their finances within the first year of their relationship – including 56% who get very candid within the first six months.

- Among Canadian married couples and those in a committed relationship, 85% of respondents say they talk about money on a monthly basis.

But even though it seems most Canadians surveyed aren’t shying away from the (financial) “talk”, the TD Love and Money survey also shows that some Canadian respondents may be more likely to ask for forgiveness than permission.

- Among the 8% of Canadian survey respondents who admit to keeping financial secrets from their partner, 62% don’t ever plan to disclose them. Canadian couples surveyed admit to hiding a secret bank account (29%) or a significant credit card debt (22%).

- Only 53% of Canadian Millennial respondents say they agree with their partner on what expenses constitute a ‘want’ and a ‘need’.

- 81% of Canadian Millennials surveyed admit to making unreasonable financial decisions, and one quarter (25%) say excessive and frivolous spending was one of them.

“Money conversations include chatting about a dream vacation or getting on the same page with a budget. It’s all about creating a financial map for your future together,” says Melissa Leong, personal finance author, speaker and television personality. “For couples, talking about money early and often is key to achieving shared goals. Also, there are ways of ensuring that these talks are positive and productive,” Leong explains.

Tying the knot: Insights from both sides of the border

As expected, walking down the aisle looks very different during the pandemic, as many North American couples deal with the impact of lockdowns, gathering restrictions and reduced income. Consequently, Love and Money reveals that of the engaged Canadian couples surveyed whose wedding planning was impacted by the pandemic, more than half (56%) either postponed or downsized their nuptials.

“So much of wedding planning stress comes down to finances,” says Leong. “With COVID resulting in many celebrations being scaled back or postponed, this is a good opportunity to talk with your partner, and also with a financial professional, about ways to responsibly repurpose your budget,” Leong suggests.

When it comes to the big day, the TD survey also shows:

- 53% of Millennial respondents in Canada think it’s okay to take financial risks when planning a wedding, versus 63% in the U.S.

- 46% of Canadian respondents say the couple should pay for all wedding expenses, versus 35% in the U.S.

- 49% of married Canadian respondents spent less than $5,000 on their wedding and 31% spent between $5,000 and $15,000, versus 49% and 20% respectively in the U.S.

- 14% of married and engaged Canadian respondents and 11% of their U.S. counterparts did not buy an engagement ring nor see it as necessary.

Love and Money

In terms of financial worries, the TD Love and Money survey goes on to reveal that the greatest financial concern among Canadians surveyed is the fear of not being able to retire. Despite this concern, only one third (32%) of Canadian respondents say they meet with a financial advisor on an annual basis.

“Candid and frequent conversations about money are an essential part of establishing and maintaining a successful financial relationship,” says Frank Psoras, SVP, Customer Strategy, Innovation and Acquisition. “From moving in together, to planning a wedding, buying a home, having a family or saving for education and retirement – every couple has a unique situation. Seeking personalized, financial advice from a professional and developing a plan could help you achieve your financial goals.”

According to Love and Money, 17% of Canadian couples surveyed say they need advice on investments, 14% on paying off debts, 13% need advice on retirement, and 11% on budgeting.

“While how much, why and how you save, spend and invest your money is your personal choice, the results show that many Canadians surveyed are looking for professional advice to inform their decision-making. Whether it’s saving or investing, planning for today or for tomorrow, TD is ready to help customers feel confident about their finances,” shares Psoras.

TD is helping many Canadians with their finances during these uncertain times through personalized financial advice and everyday banking capabilities via online tools, including:

- TD Ready Advice provides information and articles on a variety of financial topics, from how to keep track of day-to-day expenses to how to navigate the first-time homebuying process.

- TD MySpend is a mobile app that can help you track your purchases and transactions made from your personal TD Canadian dollar savings, chequing and credit card accounts and automatically groups them into categories, to help you understand how you spend your money.

- 6,600+ TD advisors are available across the country to help provide personalized financial advice and help customers with their financial goals.

- TD Stories provides a range of informative articles about personal finances, budgeting and fraud prevention.