Are You Finding it Challenging to Save?

In a holiday season where social distancing kept many families and friends apart, Canadian shoppers polled compensated by spending an average of $735 – the highest amount since the RBC Post-Holiday Spending & Saving Insights Poll began tracking these expenditures a decade ago.

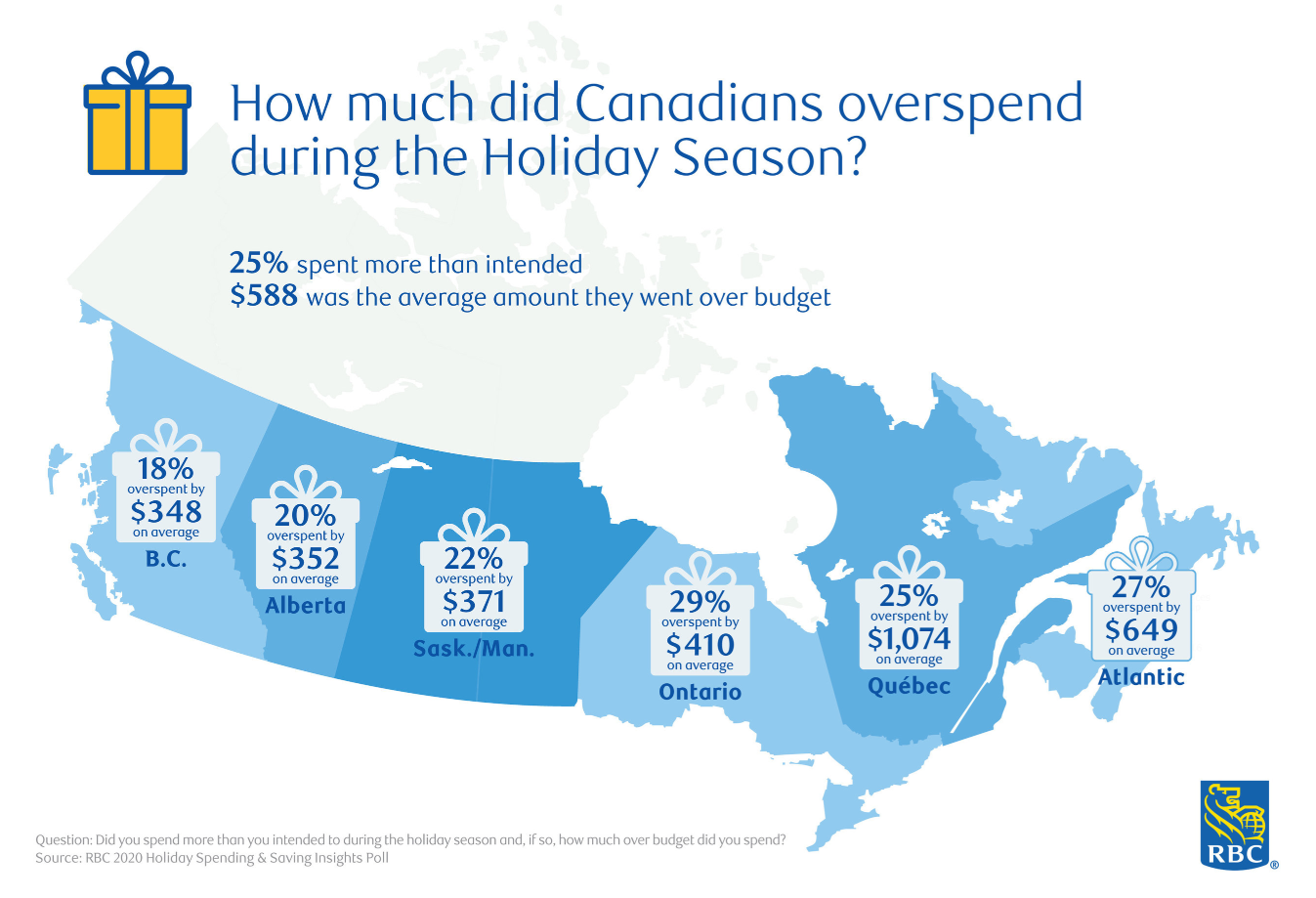

Another record was set by those who spent more than intended (25% of all shoppers), going over budget by $588 on average – a 28% increase from $459 the previous holiday season. The biggest overspenders were in Ontario (29%), followed by residents of Atlantic Canada (27%), Quebec (25%), Saskatchewan and Manitoba (22%), Alberta (20%) and B.C. (18%). By age group, Canadians 18 to 34 included the largest percentage of overspenders (38%); by gender, more men overspent than women (27% vs. 23%).

Two-thirds (67%) of those who spent more than they planned have yet to pay off their holiday bills. One quarter have immediate actions in mind to help take care of those expenses, such as cutting back on entertainment (24%) – one of the biggest holiday season expenditures – and daily living expenses (23%), while 16% expect to carry a balance on their credit card for at least two months.

Overall, Canadians polled identified a number of things they would do differently to prepare for the next holiday season, including setting aside savings on a regular basis (20%) and spending less/resisting any temptations to spend more than they’ve saved (16%).

One of the biggest challenges they now face: how to actually save money throughout the upcoming year. When asked how much extra they might be able to save in 2021, 50% responded ‘I have no idea’ and a further 22% stated they weren’t saving at all right now and didn’t think they’d have anything extra to set aside over the next 12 months.

“We know Canadians have the best of intentions about saving and that it can be difficult to set a budget and stick to it. In these uncertain times, we’re also seeing that, while some are able to save more than they thought because they are spending less, others are struggling to make ends meet as a result of the pandemic,” says Niranjan Vivekanandan, Vice-President, Term Investments & Savings, RBC. “That’s why we have NOMI Find & Save and NOMI Budgets in place, to help clients save and to simplify the budgeting process, regardless of the situation they are navigating. We are here to help in all instances.”

NOMI Find & Save has helped clients save more than $1 billion

NOMI Find & Save recently marked a major milestone in helping Canadians save in an effortless way: it has now found more than $1 billion for clients, since launching in 2017. Over the past year, NOMI Find & Save has helped clients save an average of $358 a month. NOMI Find & Save uses predictive technology to automatically find extra money that it thinks won’t be missed, and sets that money aside as savings. NOMI Budgets uses artificial intelligence to take the thinking and manual calculator work out of creating a budget. It proactively analyzes a client’s spending history, recommends an appropriate budget and sends timely updates to help keep clients on track in a seamless and convenient way.

“When our poll asked Canadians what they would do with ‘found’ money, they had several ideas in mind – including paying down debt (35%), adding to their general savings (32%) and saving for a specific purpose (25%). Very few responded they didn’t know what they’d do with extra funds (8%),” added Vivekanandan. “Imagine what they could do with an extra $358 of ‘found’ money a month!”

About NOMI Find & Save and NOMI Budgets

Since it launched in 2017, NOMI Find & Save has now helped clients find more than $1 billion. Savings for NOMI Find & Save users over the past year have averaged $358 a month, which can add up to almost $4,300 extra at year-end. Through predictive technology, NOMI Find & Save anticipates your overall monthly spending, finds extra money that it thinks won’t be missed and automatically sets it aside for you as savings. You can access your money at any time, through free transfers to your source chequing account. You can view your balance, pause and restart, 24/7 and the two-way transfer feature automatically transfers this money back when you need it. NOMI Budgets, introduced in 2020, has helped more than 950,000 customers set approximately 1.7 million budgets.

NOMI Budgets takes the thinking — and the manual calculator work — out of setting up a budget. It takes a close look at your spending and recommends a personalized monthly budget based on your habits, keeping you on track by sending regular updates through the RBC Mobile app’s budget tracker. By simplifying savings and the budgeting process, we’re making it easier for Canadians to manage their spending and make responsible financial decisions. More information is available at NOMI Find & Save and NOMI Budgets.