Greedyrates, a leading personal finance site, has released a report examining the past decade of Canadian spending habits. The report found that Canadians are feeling…

Greedyrates, a leading personal finance site, has released a report examining the past decade of Canadian spending habits. The report found that Canadians are feeling…

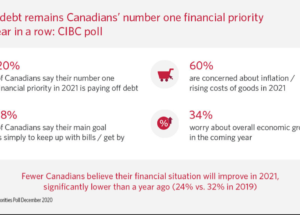

Despite a global pandemic and financial uncertainties, a new CIBC study finds that for the 11th straight year, paying down debt remains the number one financial…

While majority of Canadians (73 percent) are likely to make impulse purchases for gifts this holiday season, 40 percent don’t have a plan on how…

The annual BDO Canada Affordability Index, which examines how affordable life is in Canada, reveals that as Canadians struggle to make ends meet and manage growing debt,…

The proportion of Canadians who are $200 or less away from financial insolvency at month-end has jumped a significant six points since September, from 40…

A worry-free retirement may be a thing of the past as Canadians struggle to manage debt. From living with a mortgage to unpaid credit cards,…

It’s mid-January. The holidays are over, you are back to work, and the kids are back in school. Life gets back to normal right? Hopefully…

A new poll from CIBC finds that paying down debt is once again the top financial priority for Canadians in 2017, the seventh straight year…

BMO Wealth Management today issued a report on “The Personal Balance Sheet,” examining how Canadians adapt financially as they move through different life stages ΓöÇ…

Keep your credit card balance (if you carry one) to less than 30% of the available limit. This will help your credit score. The more…