- Stats: 3302 0 72

- Author: Money Bloggess

- Posted: February 9, 2018

- Category: CIBC

Am I saving enough to retire? Vast majority of Canadians just don’t know: CIBC poll

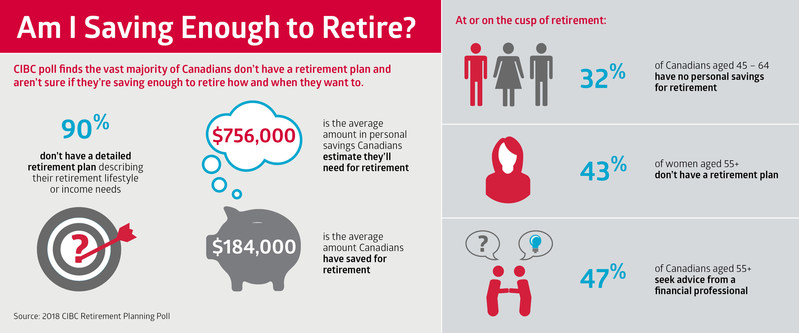

Canadians estimate that they will need an average of $756,000 in retirement savings, but the vast majority (90 per cent) do not have a plan to achieve the lifestyle they want in their golden years, a recent CIBC poll finds. Moreover, women are less likely than men to be retirement ready and more apt to rely on the advice of family and friends.

“If you don’t have a retirement plan, you’re throwing darts at numbers in the dark, guessing at how much you’ll need to live on comfortably once you’ve stopped working,” says Jennifer Hubbard, Managing Director, CIBC Financial Planning and Advice. “It’s important to take an honest look at your finances today, and determine ‘what’ your retirement goals and dreams are because that will influence ‘when’ you retire and ‘how much’ it will cost. That way, you can find the best path to get from here to there.”

A retirement plan involves determining the lifestyle you want to lead in retirement and identifying your sources of income over and above employer-sponsored plans, the Old Age Security and Canada Pension Plan, or Quebec Pension Plan, estimating your expenses, having a savings program, and managing your assets based on your risk tolerance.

Key poll findings:

- 90 per cent of Canadians, who are not currently retired or semi-retired, do not have a formal and detailed retirement plan that describes the lifestyle they want

- 53 per cent aren’t sure if they’re saving enough

- 37 per cent either aren’t able to save or haven’t thought about retirement

- $756,000 is the average amount Canadians estimate they’ll need in personal savings to retire comfortably, while 26 per cent don’t know

- Millennials (aged 18-34) believe they’ll need the most at about $917,000, compared to $842,000 for Generation X (aged 35-54), and $518,000 for Boomers aged 55+

- $184,000 is the average amount Canadians say they’ve saved for retirement

- 30 per cent have no retirement savings, and a further 19 per cent have saved less than $50,000

- 63 is the average age at which Canadians plan to, or did, retire

On the cusp of retirement

The poll findings also show that almost a third (32 per cent) of those nearing, or on the cusp of retirement age (45-64), have nothing saved for their retirement; and among those with retirement savings, the average value of their nest egg is $345,000, while most (49 per cent) have saved less than $250,000.

“It’s less about how much you’ve saved, but how your savings line up — or don’t line up – with your lifestyle goals that really matters,” says Ms. Hubbard. “With so much on the go, your retirement plan can be the single most powerful and effective tool for building your wealth and financial security. And, it’s never too late to start.”

Fewer women than men prepare for retirement

The poll also finds that fewer women than men have a formal retirement plan, or at least a ‘good idea’ what their retirement income needs will be, 22 per cent compared to 32 per cent, respectively. Further, far more women than men at or nearing retirement (aged 55+) don’t have a plan in place, 43 per cent compared to 27 per cent, respectively.

Nearly a third (32 per cent) of women admit they ‘don’t know’ how much personal savings they’ll need to retire comfortably, compared to 19 per cent of men, and among those with retirement savings, women have saved on average nearly 25 per cent less than men.

While the findings show few women and men seek expert advice when saving for retirement, more women than men rely on the advice of family and friends, especially those closest to retirement age (55-64) at 21 per cent and 14 per cent, respectively.

Despite the vast majority of women being either the primary or joint decision makers when it comes to investing for their household, only half said they feel confident or knowledgeable when it comes to their finances, previous CIBC research found.

“The value of having a trusted financial advisor and personalized financial roadmap is in the confidence and peace of mind it gives you knowing that you’re saving enough to comfortably live the life you want both now and down the road,” says Ms. Hubbard.

Tips to Retire Well:

- Plan your lifestyle – make the future as predictable as possible

- Understand your spending today and estimate what it’s likely to be in retirement

- Work with a financial advisor to project your income and expenses

- Put your plan on auto-pilot with regular deposits to a dedicated savings account

- Invest for the long term and revisit your investment plan regularly, at least once a year

- Determine the best time to draw down on public pension benefits or personal savings

About the 2018 Retirement Savings Poll:

From January 12th to January 14th 2018 an online survey was conducted among 1,523 randomly selected Canadian adults who are Angus Reid Forum panellists. The margin of error—which measures sampling variability—is +/- 2.5%, 19 times out of 20. The results have been statistically weighted according to education, age, gender and region (and in Quebec, language) Census data to ensure a sample representative of the entire adult population of Canada. Discrepancies in or between totals are due to rounding.

About CIBC

CIBC is a leading Canadian-based global financial institution with 11 million personal banking, business, public sector and institutional clients. Across Personal and Small Business Banking, Commercial Banking and Wealth Management, and Capital Markets businesses, CIBC offers a full range of advice, solutions and services through its leading digital banking network, and locations across Canada, in the United States and around the world. Ongoing news releases and more information about CIBC can be found at www.cibc.com/en/about-cibc/media-centre.html or by following on LinkedIn (www.linkedin.com/company/cibc), Twitter @CIBC, Facebook (www.facebook.com/CIBC) and Instagram @CIBCNow.

SOURCE CIBC – Consumer Research and Advice

72 comments

Leave a Reply

You must be logged in to post a comment.

this is was the talk in global radio today. emphasizing more to save money for retirement. too bad more than half the young canadians did not plan to save for retirement.

How do I make my previous Yahoo 360 blog posts visible to the public?

Keep on writing, great job!

Omaha, NE dog walking and cat sitting.

Cool blog! Is your theme custom made or did you download it from

somewhere? A design like yours with a few simple adjustements would really

make my blog jump out. Please let me know where you got your design.

Bless you

Wonderful beat ! I wish to apprentice while you amend your site, how can i subscribe for a

blog site? The account helped me a acceptable deal. I had been a little bit acquainted of this your broadcast provided bright clear concept

Fix brackets in place, attach risers and treads.

I visited multiple web sites but the audio quality for audio songs existing at this web

site is genuinely superb.

An older model of the Septic tank is the Cesspool.

You should definitely take a look at our classic car providers.

Tap water is not cleaner than bottled water.

The oldest bail bonding firm in Kansas Metropolis.

Oil tank removing in NY or CT doesn’t take lengthy.

Tow Truck & Wrecker Towing Service North Houston TX.

The job outlook for insurance agents is sweet.

The average value of these piers is $300 per pier.

I dugg some of you post as I thought they were very beneficial invaluable

Save as much as $603 by reserving Flight + Lodge.

When some one searches for his necessary thing, therefore he/she desires to be available that in detail,

thus that thing is maintained over here.

Intresting, will come back here later too.

No one can guarantee a #1 rating on Google.

Very interesting points you have remarked, appreciate it for putting up.

Good, this is what I was searching for in yahoo

Why visitors still make use of to read news papers when in this

technological world the whole thing is accessible on web?

Superb, what a website it is! This weblog provides helpful data to us, keep it up.

It’s really very difficult in this active life to listen news on Television,

so I only use web for that purpose, and obtain the latest information.

Your style is really unique in comparison to other people I’ve read stuff from.

Thanks for posting when you have the opportunity, Guess I will just bookmark this

site.

So we started trying into doggie daycare locations.

Hey there, You’ve done a great job. I will definitely digg

it and personally suggest to my friends.

I’m sure they’ll be benefited from this site.

Enjoyed reading through this, very good stuff, thankyou .

We offer tow service and roadside assistance 24 hours.

First, we’ll clarify the blockchain basics.

The origins of blockchain are a bit nebulous.

We’re your best towing firm in Atlanta.

In impact, the blockchain customers are the administrator.

Daniel did an excellent job cleaning my carpet.

Tow truck drivers work long hours every day.

Dave Hastert is an amazing carpet cleaning man.

In search of a Michigan carpet cleansing service?

Bitcoin and blockchain technology will not be the identical.

Gary Hunt was wonderful at cleaning my carpet.

Why is blockchain now getting a lot buzz?

We also provide service in downtown towing Miami.

Daniel did an incredible job cleansing my carpet.

Christina was our driver of the social gathering bus.

Wallets safe funds by guarding our private keys.

I must say got into this article. I found it to be interesting and loaded with unique points of view.

Get the most effective info on native portray providers.

Items might be picked up in your appointment day.

I like this site because so much useful stuff on here : D.

We didn’t discover outcomes for: water treatment

services.

24 Hour Portland Towing can even tow motorcycles!

We are your best towing company in Atlanta.

Do you have cracks in your foundation partitions or

flooring?

Faucet water is not cleaner than bottled water.

The repairs should not have to value a lot of money.

Huntington Lengthy Island Cesspool Service from Magnum.

These are all symptoms of foundation points needing

repair.

The typical value of those piers is $300 per pier.

Use a twig bottle and soak the stucco with this oil.

I might undoubtedly recommend Okay.C. Waterproofing.

Eager about refinishing hardwood flooring?

These are all signs of foundation issues needing repair.

Do you will have cracks in your foundation walls or flooring?

Hey, happy that i stumble on this in google. Thanks!

BBB Enterprise Profiles are topic to vary at any time.

Professionals ought to deal with tree service.

You do not have to make use of a mold killing product.

Black toxic mold seems black or darkish green.

$30.00 off any Service Call with repairs.

Cleans and prepares ground for high polish.

A fantastic cup of coffee is the only thing that could make this blog better.