- Stats: 1787 0

- Author: Linda

- Posted: February 26, 2019

- Category: Insurance, Women & Finances

Canadian women are relatively well-prepared financially: RBC Insurance Poll

Highlights:

- The majority of women over 45 have a very clear idea of what they would do with a sudden lump sum of money, with only a quarter worry about being able to manage the money properly.

- Canadian women have also mastered the household money matters. More than nine in 10 (92 per cent) agree they have a strong understanding of their finances.

- Yet despite this, 24 per cent say they won’t be able to maintain their household’s financial situation if their spouse or partner were to pass away and one-third are not confident that they will be able to afford the lifestyle they want to live through retirement.

When it comes to insuring their financial future, Canadian women over 45 are relatively well-prepared. The majority have a very clear idea of what they would do with a sudden lump sum of money, and only a quarter (24 per cent) worry about being able to manage the money properly, according to a recent poll from RBC Insurance. A large majority (94 per cent) express a prudent approach, agreeing that they would develop a strategy for making the money last. Other top responses include looking for ways to help protect the money from risks such as market volatility (92 per cent) and considering investing in products that provide guaranteed income (91 per cent).

“Women are expressing a strong interest in long-term financial strategies, risk mitigation and products that can provide guaranteed income,” said Selene Soo, Director, Wealth Insurance, RBC Insurance. “There are solutions available that women should consider as part of their retirement plan that can provide guaranteed income for life, potential tax benefits and the ability to protect beneficiaries, to name a few.”

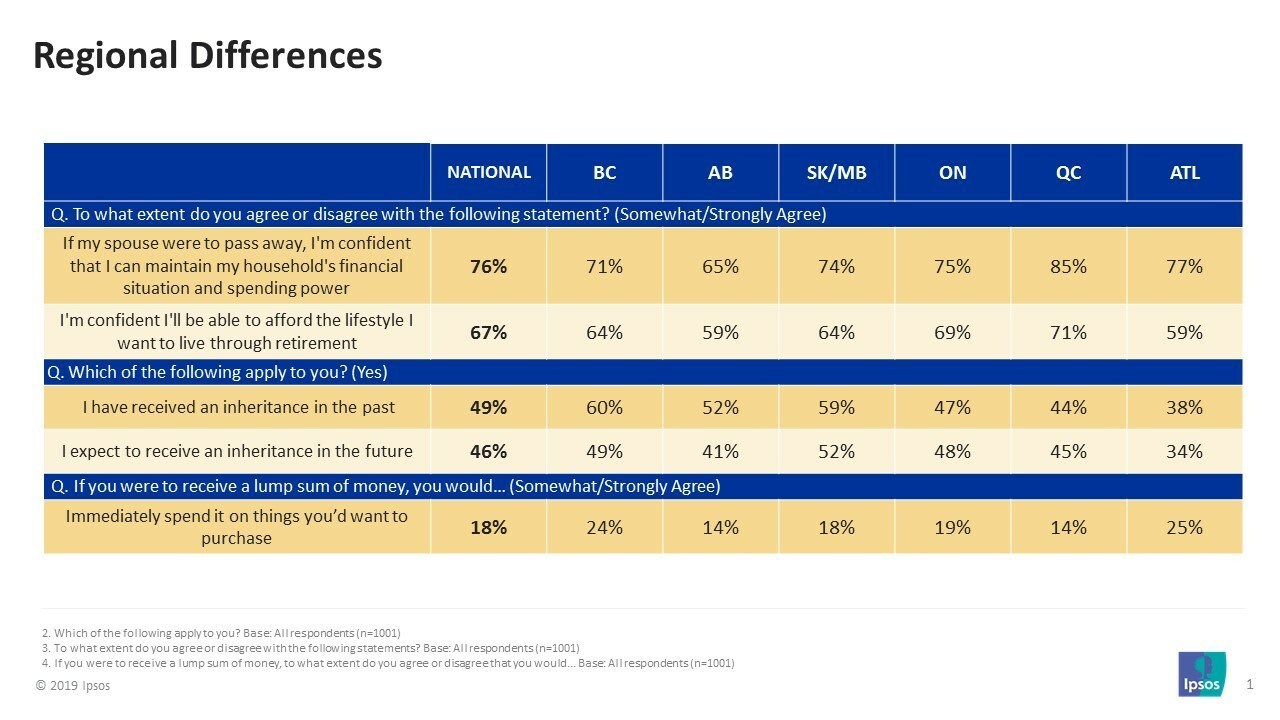

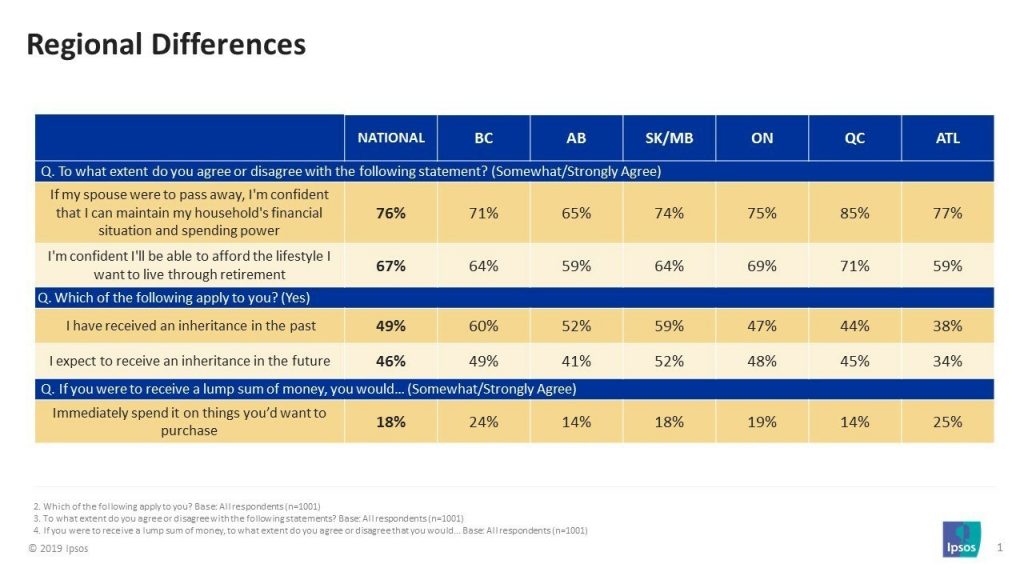

Canadian women have also mastered the household money matters. More than nine in 10 (92 per cent) agree they have a strong understanding of their finances, regardless of marital status. Yet, one quarter (24 per cent) say they won’t be able to maintain their household’s financial situation if their spouse or partner were to pass away, a figure that increases to 30 per cent for women between the ages of 45-54, versus 14 per cent of women 65+.

Despite this, the poll also revealed varying degrees of confidence when it comes to women’s financial future. One-third (33 per cent) of women overall are not confident that they will be able to afford the lifestyle they want to live through retirement. In particular, women between 45-54 are most likely (38 per cent) to express this uncertainty around the future, compared to 22 per cent for women 65+. Interestingly, single women were only slightly more likely than married women (36 vs. 34 per cent) to cite a lack of confidence in their ability to afford their lifestyle in retirement.

“Women have long been managers of the day-to-day activities and spending in households across the country and we’re pleased to see this reflected in their confidence about the household finances,” adds Soo. “Yet, there still is some uncertainty around their ability to maintain the same lifestyle into the future, so looking critically at their financial needs and having a plan for all scenarios will go a long way to maintaining that confidence right through retirement.”

Keeping it in the family:

The majority (84 per cent) of Canadian women would like to leave an inheritance for their loved ones. Half (49 per cent) have received an inheritance themselves in the past, while a slightly smaller proportion (46 per cent) expect to receive one in the future. However, women are not depending on an inheritance to fund their retirement, with only 17 per cent agreeing that they are relying on one to help them get through their retirement years.

While women have their finances relatively well in hand, there is always room for improvement. When it comes to increasing confidence in, and preparing for their financial future, Canadian women should consider the following as part of their investment portfolio:

- Products such as annuities provide a predictable income stream for as long as you live, regardless of whether financial markets rise or fall.

- Estate planning is a key component for your financial legacy. Have the conversations early and plan for a transfer of wealth. Segregated funds can be a good option as it provides unique estate planning benefits which aren’t available in other types of investment products.

- Speak to an advisor to discuss options and ensure you’re on track to meet your long-term financial goals.

SOURCE RBC Insurance